Quicken For Mac 2018 Trial

I personally stayed on Quicken 2007 until the end of last year when I finally moved to 2017. I have been using Quicken since version 1 so I have my entire banking and investment history in Quicken. I heard all the complaint with Quicken money, 2015 and 2016 so I stayed away and had no choose but to move to 2017 because 2007 was no longer support on Sierra. There are a few feature which I miss from 2007, but they fix a number of issue with online banking specifically with investments account which was not supported in 2007. Over all 2017 works well, and organized things better than 2007 did. Personally I am not going to 2018, no need to pay Quicken to help me optimize my investments. The only issue i have is the online balance in the mobile app not matching what I show on the Mac, this is has been an on and off issue with Quicken 2017.

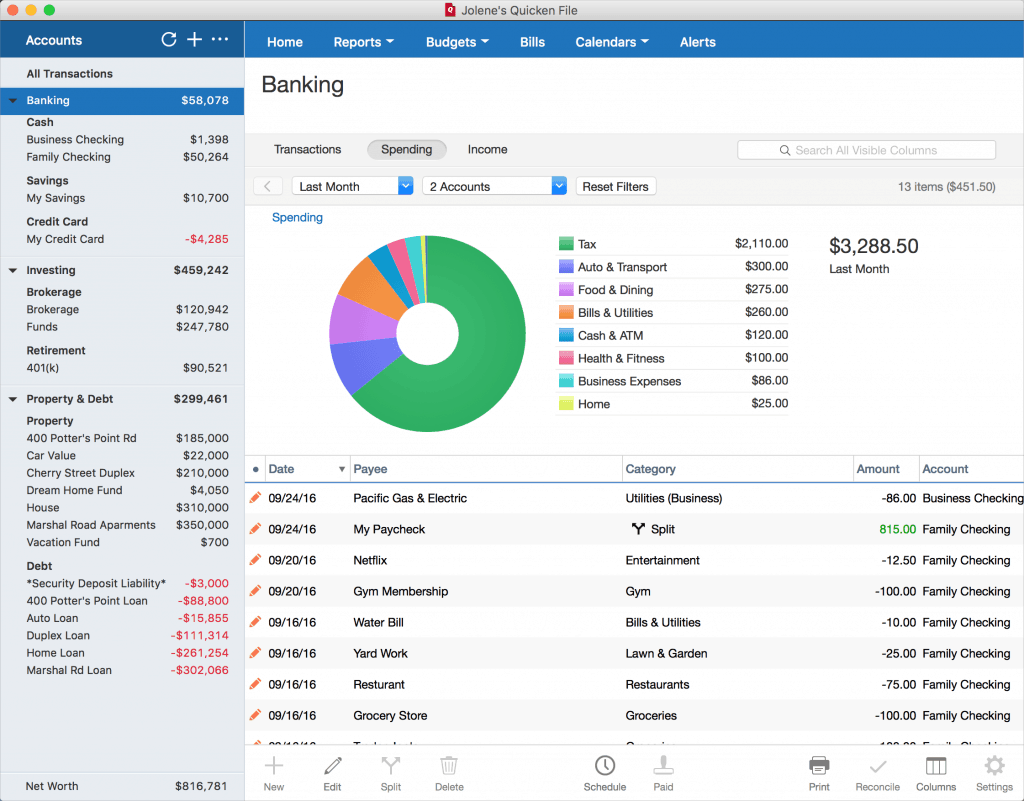

Announced the next version of its self-titled flagship product, Quicken for Mac 2018 (and Quicken for Windows). The company has three different version of the accounting and billing. 1-16 of 74 results for 'quicken mac 2018'. By Quicken Deluxe 2017 Software - No subscription needed. Currently unavailable. 3.6 out of 5 stars 9.

For those who switch to other banking software, I played with them all, and yes Quicken did not keep up, mostly from GUI stand point, but those other software were simplistic, especially when it came to investment activities. If all you were doing was checking and credit cards they were probably fine. I personally like how Quicken use to minor your check registry. But time moves on and no one really records checks in their registry anymore. Hell I hardly write a check today. I mainly use Quicken to monitor all my various investment accounts. Since using online balance reconciliation I had very few issues.

«12»Comments

Quicken 2017 For Mac

Quicken For Mac 2017 To Quicken For Mac 2018 Review

- Quicken for Mac 2017 is much improved. I tried other products including those others have mentioned here and they all fell far short from my perspective.

An area with Quicken (and all other products) fail is investment tracking.

I also tried out Quicken for Windows under a VM. After so much praise for the Window's version, I could hardly contain my disappointment on how really crappy the Windows version was.

Really, I subscription model does make sense, if the company is making improvements. We all like free but nobody eats for free, or provides services for free. I'm not willing to work for free, and I don't expect anyone else to. - This is what company's do these days. Can't make much money anymore selling people software because what NEW things can you add at this point to get people to buy a updated version? Instead, you go Subscription, then kick back and let the money roll in at regular intervals you can predict.

If I recall correctly, the recent versions of Quicken (i.e., 2017) gave you online access for about 3 years. So under that model you'd have to upgrade about every three years to have everything continue working. (Note, I'm still using Quicken 2007 on Sierra and all of the online features I use still work...not sure when that gravy train will end though.)

Since I'm not a Quicken user - what did the previous Quicken application give you? Could you keep the online access to your information with a purchase of a standalone app? Or was there another level that you needed to purchase to have those features? If it's the latter, then I cede the point. If the former, however, then my point stands firm.

According to Quicken's support FAQ, if you stop paying for the software you no longer get software updates nor do you get online access to banks, credit cards, or investments. You can, however, continue to enter transactions manually, run reports, and export data just like you could in previous versions of Quicken.

Um, just because it's not monthly doesn't make it 'not a subscription model'. Do people pay monthly for a monthly magazine? Nope, they pay yearly, and it's called a magazine subscription.Not really a subscription model, you pay for the new version and If you don't want it next year you cancel. No monthly payments...

If you buy a standard application, you can use it in perpetuity (as long as your system runs).

You buy this Quicken and then stop paying, you don't get your magazine software anymore.

So do the math... Q2017 was $75 and was fully functional for 3 years. Q2018 is $50/year (since you have to buy at least the Deluxe level for features to continue working if your subscription ends). Assuming you got the full three years for Q2017, which would depend on when you purchased it, that's $75 vs $150 for three years of full functionality. Even if you purchase the 2 year subscription at $80, that's still $75 vs $120.

Assuming that the features that are disabled when your subscription runs out at the same that became disabled after 3 years for Q2017, I might be OK with the subscription model, but not at those prices. A 100% markup? They are crazy!- Interesting...Quicken web site says the subscription also gets you access to the Windows version. Wonder how the feature sets between the two version line up now.

To be clear, they don't say you can continue to run reports:

According to Quicken's support FAQ, if you stop paying for the software you no longer get software updates nor do you get online access to banks, credit cards, or investments. You can, however, continue to enter transactions manually, run reports, and export data just like you could in previous versions of Quicken.

Um, just because it's not monthly doesn't make it 'not a subscription model'. Do people pay monthly for a monthly magazine? Nope, they pay yearly, and it's called a magazine subscription.Not really a subscription model, you pay for the new version and If you don't want it next year you cancel. No monthly payments...

If you buy a standard application, you can use it in perpetuity (as long as your system runs).

You buy this Quicken and then stop paying, you don't get your magazine software anymore.

'You can view, edit, export, and manually enter transactions and accounts, even after your subscription ends.'

That could be a pretty significant difference if you can't continue to run reports as that is the most practical way to review your old data.- No standalone version is a deal breaker. Cloud? No, thanks. Not even for free.

- I never liked Quicken as there are much much better options available. I currently run 4 apps parallel to each other, MoneyWell, Banktivity (iBank), iFinance and iCompta. I personally rank MoneyWell on top because of attention to very small details, interface, smart features, quickest data entries, formulas, etc. Developer behind MoneyWell was hired by Apple. Banktivity (2nd in my list) is also good but lacks some key features that I frequently use. I like iBank more than their recent versions of Banktivity. I have also used Ynab as well in the past, its graphs and reports were strongest, but since they went subscription based only, I said good bye to them as well. But as much as I enjoy working in self developed Numbers spreadsheet, I find it enjoyable to have more freedom and control on customisation, charts, tables, etc. the way I want to.edited October 2017

- The negativity being thrown around this is insane.

Look, if you don't like cloud software that's fine. Everyone has concerns there. But this product is in a space that competes with Mint, YNAB, Every Dollar, and a bunch of others. And most of the larger brand offerings have moved to the cloud, because in 2017, mobile is a thing. And Adobe showed that subscriptions were crazy profitable, so the industry has followed.

But loud-mouths on the Mac platform have been complaining for a full decade that they absolutely needed the 2007 features back, and that feature-parity with Windows was non-negotiable. Now they've finally gotten both - along with a choice of THREE versions - and the complaining soldiers on.

I don't know if I'll consider Quicken 2018. It probably boils down to whether there's a Canada-specific Home and Business version coming that can track local stuff like HST, TFSAs etc. and print Canadian cheques. Quickbooks is $20+ a month, so any competition for that is welcome.

But I know there are home users who have major investments and others who might see $50./year as a bargain for personal financial management.

More options to Mac users are always welcome. Thanks Quicken for sticking with the Mac platform.

I have been using Moneydance for several years now. There is an iPhone / iPad version that works well, but it only works on bank accounts and credit card accounts. The iPhone / iPad version is very useful recording transactions on the move. I had used Quicken back in the days of Mac OS9 and several forced upgrade 'features' to use the online bank connection and it being less functional on the Mac every release, I stopped using it several years ago.I ditched Quicken years ago and have been using Moneydance. More features, works well, great support. Good upgrade policy. The only drawback is there's no iPad version available. Banktivity and Moneywiz are also frequently mentioned as solid apps. Unfortunately, many of the personal finance apps now charge ongoing fees for online access, so it amounts to the same thing as an app subscription. I'm not certain, but I believe part of it may have to do with fees that financial institutions charge for online access.- Anybody that thinks programs like Quicken are obsoleted by online banking doesn't have much to keep track of. Online banking only lets you look at the recent past and current status of online accounts. It doesn't allow you to track future transactio – checks written but not yet cleared, future online payments made, etc. – which is critical to ensuring that you have funds in the right places at the right times to ensure that everything clears. No online system does a good job of tracking physical assets like real estate, or produces financial statements. If your finances are really simple and you don't own much, online banking may be all you need. But when you've got eight or ten bank accounts, brokerage accounts, a variety of real estate and loans, etc., you need something like Quicken. And while Quicken for Mac has taken a long time to become a usable piece of software, it did (barely) get there with Quicken 2017, and I'm happy they continue to improve it. I don't love a subscription model, but the pricing seems borderline reasonable, and if they continue to do a good job improving the product and providing support, I'll pay it.

The pricing of most apps on the App Store has lowered the threshold that people are willing to spend on software, but subscription software isn't the answer.

It is inevitable in some cases I guess, but it's getting more and more like death by a thousand cuts.

- GnuCash is alleged to be pretty good, and free. Anyone ever tried it?

You are the rare bird here, not sflocal. I too stopped trying to use Quicken after the last version, it just isn't stable. Like sflocal, I too had constant errors in the downloads where the auto reconcile never worked right and I'd have to manually do it. Quicken couldn't figure out why, but confirmed the data stream from my bank was formatted correctly. In addition, auto complete never worked quite right, recurring transactions (like a paycheck) with splits would never work right, etc. None of which Quicken could ever explain or solve. As of the subscription, I do feel its just a money grab by. Quicken. I haven't seen enough innovation between versions to truly justify an upgrade; I always upgraded hoping it would be more reliable, more stable, faster, etc. But feature wise I can't think of all that much new in 2017 from 2016, aside from making my wallet a bit lighter. I suspect they too aren't seeing the upgrades they would like, so they are switching to a subscription to try to ease that out. Additionally, what's with the way better pricing if you go to a physical store? There is no logic at all in that.

Then explain why my “online banking interface” is operating perfectly with quicken 2017. Bank checking and saving accounts, credit cards, My Stifel Nicolaus IRA and investment accounts all update regularly without issue. I use the auto-reconciliation feature all the time. As the banks and credit card companies change their security requirements for login it’s a simple matter to update those requirements in Q2017. Oh, and bill pay works too. So one man’s “disaster” is another man’s functioning as advertised financial app I suppose? Certainly Quicken 2017 is not the be all, end all of banking apps but it isn’t the piece of crap you describe either.

And with that... I am now officially an ex-Quicken user.Quicken on Monday released the 2018 Mac edition of its personal finance software, making upgrades in areas like bill payments and investments, but primarily transitioning to a subscription-only model with Starter, Deluxe, and Premier packages.

Quicken on the Mac was a disaster when I last used it. It's one of the primary reasons I still run Windows on my Mac. Quicken 2016 and Quicken 2017 left my online banking interface inoperable so I do all my reconciliations manually, and don't even bother updating my investment accounts.Even though I already subscribe to Adobe CC (photography) and Office 365, there is no way in hell I'm going to do that with Quicken. I will keep Quicken and Quickbooks running forever on its current state as a virtual machine and be done with it. Time to look elsewhere.

I've been using Quicken since Windows 3.1 days... Buh bye...I suppose it would be interesting to place a short position on Quicken. I think they're going to tank.

No, now that Quicken has separated from Intuit their core product has become far more stable. I have no problem with either the 2016 or the 2017 versions.

You are the rare bird here, not sflocal. I too stopped trying to use Quicken after the last version, it just isn't stable. Like sflocal, I too had constant errors in the downloads where the auto reconcile never worked right and I'd have to manually do it. Quicken couldn't figure out why, but confirmed the data stream from my bank was formatted correctly. In addition, auto complete never worked quite right, recurring transactions (like a paycheck) with splits would never work right, etc. None of which Quicken could ever explain or solve. As of the subscription, I do feel its just a money grab by. Quicken. I haven't seen enough innovation between versions to truly justify an upgrade; I always upgraded hoping it would be more reliable, more stable, faster, etc. But feature wise I can't think of all that much new in 2017 from 2016, aside from making my wallet a bit lighter. I suspect they too aren't seeing the upgrades they would like, so they are switching to a subscription to try to ease that out. Additionally, what's with the way better pricing if you go to a physical store? There is no logic at all in that.

Then explain why my “online banking interface” is operating perfectly with quicken 2017. Bank checking and saving accounts, credit cards, My Stifel Nicolaus IRA and investment accounts all update regularly without issue. I use the auto-reconciliation feature all the time. As the banks and credit card companies change their security requirements for login it’s a simple matter to update those requirements in Q2017. Oh, and bill pay works too. So one man’s “disaster” is another man’s functioning as advertised financial app I suppose? Certainly Quicken 2017 is not the be all, end all of banking apps but it isn’t the piece of crap you describe either.

And with that... I am now officially an ex-Quicken user.Quicken on Monday released the 2018 Mac edition of its personal finance software, making upgrades in areas like bill payments and investments, but primarily transitioning to a subscription-only model with Starter, Deluxe, and Premier packages.

Quicken on the Mac was a disaster when I last used it. It's one of the primary reasons I still run Windows on my Mac. Quicken 2016 and Quicken 2017 left my online banking interface inoperable so I do all my reconciliations manually, and don't even bother updating my investment accounts.Even though I already subscribe to Adobe CC (photography) and Office 365, there is no way in hell I'm going to do that with Quicken. I will keep Quicken and Quickbooks running forever on its current state as a virtual machine and be done with it. Time to look elsewhere.

I've been using Quicken since Windows 3.1 days... Buh bye...I suppose it would be interesting to place a short position on Quicken. I think they're going to tank.

Back when it was kind of fluky I looked around for a replacement. But Quicken was the only high quality product that ran on my machine rather than in the cloud -- which I simply won't do with my financial stuff.

But, that said, I tend to run it for 2-3 years before upgrading -- mostly because the upgrades don't offer much to me and there just isn't much reason to pay for them. (Quicken did develop a cloud based mobile version which I think is where there development efforts were mostly going). So, I wouldn't be happy about the subscription since it would increase my cost of ownership.

... But, since I stuck with the Windows version, hopefully I will not be impacted.- But, that said, I tend to run it for 2-3 years before upgrading -- mostly because the upgrades don't offer much to me and there just isn't much reason to pay for them. (Quicken did develop a cloud based mobile version which I think is where there development efforts were mostly going). So, I wouldn't be happy about the subscription since it would increase my cost of ownership.

... But, since I stuck with the Windows version, hopefully I will not be impacted.

You will be. I just got an email from them the other day detailing the 'new and improved' 2018 version for Windows, with the same subscription model. - Folks,

After reading everything on Quicken's website about version 2018,I guessing Quicken 2017 will stop working at some point, What I mean is, they will no longer allow you to down load transaction from banks, credit cards and investments. In 2018 they said you will always have access to your data even if you do not renew, however, you will loose access to any and all the online features like transaction downloading even getting stock quotes, nothing will work if you do not pay each year. Also the mobile sync App will not work. Base on this I do not think they will allow this option in 2017 either. They can to allow 2017 to do things 2018 only allows if you pay. I have not enter transactions into Quicken in years I download everything from my accounts. If you do not pay the fee, you will be manually entering your data and Quicken becomes a glorified spreadsheet to look at your money.

I personally do not believe their is an alternative to this, if you want online automatic download from your financial institutions Quicken is the only one which does it all. - Folks,

After reading everything on Quicken's website about version 2018,I guessing Quicken 2017 will stop working at some point, What I mean is, they will no longer allow you to down load transaction from banks, credit cards and investments. In 2018 they said you will always have access to your data even if you do not renew, however, you will loose access to any and all the online features like transaction downloading even getting stock quotes, nothing will work if you do not pay each year. Also the mobile sync App will not work. Base on this I do not think they will allow this option in 2017 either. They can to allow 2017 to do things 2018 only allows if you pay. I have not enter transactions into Quicken in years I download everything from my accounts. If you do not pay the fee, you will be manually entering your data and Quicken becomes a glorified spreadsheet to look at your money.

I personally do not believe their is an alternative to this, if you want online automatic download from your financial institutions Quicken is the only one which does it all.

You should still be able to download transactions directly from your bank, if they offer that, rather than going through Quicken's servers. All of my banks offer this, and I sometimes resort to that mechanism when Quicken's servers are having a problem, which seems more often lately.Yes, it's more labor intensive logging into each individual bank's web site and downloading transactions for each individual account, but it's still possible.

Actually Quicken 2017 really does not support QIF anymore. It has to be a direct connection to your bank, problem is Quicken 2017 actually routes the connection through their servers now. It look like if you do not pay the subscription you going to be out of luck getting data from your financial institution. I use to down load transaction into a CVS file since many financial institution did not support QIF or QFX files, i had program which would convert the CVS file to QIF and allow me to import it into Quicken 2007, when I switch to 2017 that function stop working. Luckily for me 2017 support direct connects to all those financial institutions which were not supported in 2007.Folks,

After reading everything on Quicken's website about version 2018,I guessing Quicken 2017 will stop working at some point, What I mean is, they will no longer allow you to down load transaction from banks, credit cards and investments. In 2018 they said you will always have access to your data even if you do not renew, however, you will loose access to any and all the online features like transaction downloading even getting stock quotes, nothing will work if you do not pay each year. Also the mobile sync App will not work. Base on this I do not think they will allow this option in 2017 either. They can to allow 2017 to do things 2018 only allows if you pay. I have not enter transactions into Quicken in years I download everything from my accounts. If you do not pay the fee, you will be manually entering your data and Quicken becomes a glorified spreadsheet to look at your money.

I personally do not believe their is an alternative to this, if you want online automatic download from your financial institutions Quicken is the only one which does it all.

You should still be able to download transactions directly from your bank, if they offer that, rather than going through Quicken's servers. All of my banks offer this, and I sometimes resort to that mechanism when Quicken's servers are having a problem, which seems more often lately.Yes, it's more labor intensive logging into each individual bank's web site and downloading transactions for each individual account, but it's still possible.

It looks like Quicken plans to stop supporting 2017 in 2020, so we have about 2 yrs before you will have to move to a subscription model to get access to the online data. BTW when the discontinue support you will not even get stock quotes update, 2017 will be come an achieve of data frozen in time.

https://www.quicken.com/support/quicken-discontinuation-policy